Delving into Risk management principles, this introduction immerses readers in a unique and compelling narrative, with casual formal language style that is both engaging and thought-provoking from the very first sentence.

Exploring the essence of risk management principles is crucial for businesses to thrive amidst uncertainties. By understanding the key components, significance of integration, and real-world examples, organizations can navigate risks effectively.

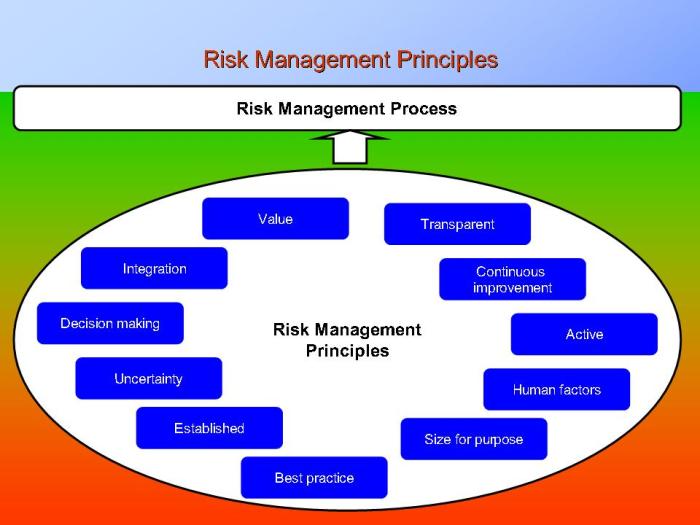

Risk Management Principles

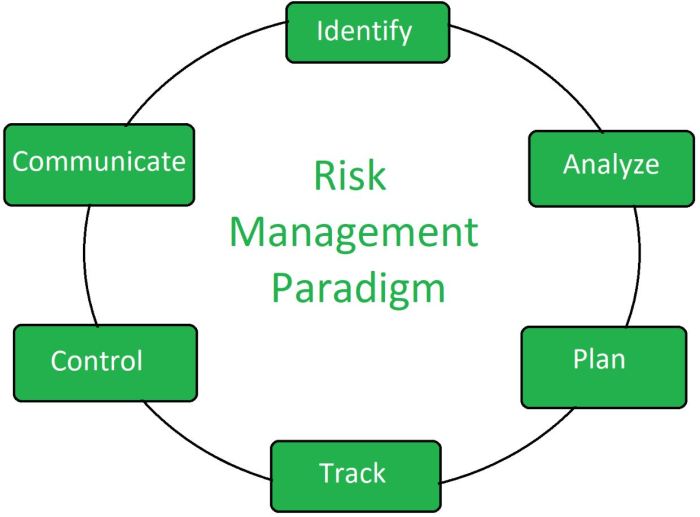

Risk management principles are guidelines and rules that organizations follow to identify, assess, and mitigate risks that could potentially impact their operations. These principles help businesses anticipate potential threats and opportunities, allowing them to make informed decisions to protect their assets and achieve their objectives effectively.

Key Components of Effective Risk Management Principles

- Identification of Risks: Understanding and recognizing potential risks that could affect the organization.

- Assessment of Risks: Analyzing the likelihood and impact of identified risks on the business.

- Risk Mitigation Strategies: Developing and implementing plans to minimize or eliminate risks.

- Monitoring and Review: Regularly evaluating and updating risk management processes to ensure effectiveness.

Importance of Integrating Risk Management Principles into Business Operations

Risk management principles are crucial for organizations as they help in protecting assets, improving decision-making, enhancing operational efficiency, and ensuring long-term sustainability. By integrating these principles into their operations, businesses can proactively manage risks and seize opportunities for growth and success.

Examples of Industries that Heavily Rely on Risk Management Principles

- Financial Services: Banks, insurance companies, and investment firms heavily rely on risk management principles to safeguard assets and maintain financial stability.

- Healthcare: Hospitals and healthcare providers use risk management principles to ensure patient safety, regulatory compliance, and operational continuity.

- Construction: Construction companies implement risk management principles to address safety hazards, project delays, and budget overruns.

Risk Assessment

Risk assessment is a crucial step in the risk management process that involves identifying, analyzing, and evaluating potential risks that could impact an organization’s objectives. By conducting a thorough risk assessment, organizations can make informed decisions to mitigate or avoid these risks, ultimately enhancing their resilience and success.

Steps in Conducting a Thorough Risk Assessment

- Identify Risks: The first step is to identify all potential risks that could affect the organization’s operations, assets, or goals.

- Analyze Risks: Once identified, each risk should be analyzed to understand its likelihood of occurring and the potential impact it could have.

- Evaluate Risks: Risks are then evaluated based on their significance, allowing organizations to prioritize and focus on the most critical ones.

- Treat Risks: After evaluation, appropriate risk treatment strategies are developed to manage or mitigate the identified risks.

Tools and Techniques for Risk Assessment

- Interviews and Workshops: Engaging with stakeholders through interviews and workshops can provide valuable insights into potential risks.

- Checklists and Documentation Review: Utilizing checklists and reviewing relevant documentation can help in identifying and assessing risks.

- SWOT Analysis: Conducting a SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis can assist in identifying both internal and external risks.

Qualitative vs Quantitative Risk Assessment Methods

- Qualitative Risk Assessment: Qualitative methods assess risks based on subjective criteria such as impact and likelihood, often using scales like low, medium, and high.

- Quantitative Risk Assessment: Quantitative methods involve numerical analysis to quantify risks in terms of financial impact, probability, and other measurable factors.

Risk Tolerance

Risk tolerance is the level of risk that an organization is willing to accept in pursuit of its objectives. It plays a crucial role in risk management as it guides decision-making regarding which risks are acceptable and which need to be mitigated. Determining risk tolerance involves assessing the organization’s risk appetite, considering its goals, objectives, and stakeholders.

Significance of Risk Tolerance

Determining risk tolerance within an organization is essential as it helps in aligning risk management strategies with the organization’s overall objectives. By clearly defining the level of risk that the organization is willing to take, it provides a framework for evaluating and prioritizing risks. This, in turn, ensures that resources are allocated effectively to manage risks that fall within acceptable tolerance levels.

Factors Influencing Risk Tolerance

Several factors can influence an organization’s risk tolerance level, including the industry it operates in, regulatory requirements, financial stability, corporate culture, and risk management capabilities. For example, a highly regulated industry such as banking may have a lower risk tolerance compared to a technology startup operating in a dynamic market environment.

Variation of Risk Tolerance Across Industries

Risk tolerance can vary significantly across different industries based on their unique characteristics and risk profiles. Industries with high levels of competition and innovation, such as technology and healthcare, may have a higher risk tolerance to drive growth and stay ahead in the market. On the other hand, industries like utilities and insurance, which focus on stability and long-term sustainability, may have a lower risk tolerance.

Risk Mitigation

Risk mitigation is a crucial aspect of risk management that involves taking proactive steps to reduce or eliminate the potential impact of risks on a project, organization, or individual. It is closely related to risk management as it focuses on identifying, assessing, and addressing risks before they can escalate into major issues.

Strategies for Mitigating Risks Effectively

Effective risk mitigation strategies involve a combination of preventative measures, contingency plans, and risk transfer mechanisms. Some common strategies include:

- Implementing robust security measures to prevent data breaches and cyber attacks.

- Diversifying investments to reduce financial risks associated with market fluctuations.

- Developing emergency response plans to mitigate the impact of natural disasters or other unforeseen events.

- Regularly reviewing and updating risk management policies and procedures to ensure they remain relevant and effective.

- Training employees on risk awareness and best practices to prevent human error and operational failures.

Role of Risk Mitigation Plans in Reducing Potential Impacts

Risk mitigation plans play a critical role in reducing potential impacts by providing a structured approach to identifying, assessing, and addressing risks. These plans help organizations anticipate and prepare for potential threats, minimize vulnerabilities, and respond effectively in case of emergencies. By implementing proactive risk mitigation strategies, organizations can enhance their resilience and protect their assets, reputation, and stakeholders.

Examples of Successful Risk Mitigation Strategies

One example of a successful risk mitigation strategy is the implementation of backup systems and data storage solutions to prevent data loss in case of system failures or cyber attacks. Another example is the use of insurance policies to transfer financial risks to third-party providers in case of unforeseen events such as accidents or lawsuits. These strategies have proven effective in reducing the impact of risks and ensuring business continuity in real-world scenarios.

In conclusion, embracing sound risk management principles is paramount for organizational success. By incorporating effective strategies, businesses can proactively address risks and optimize decision-making processes, ensuring long-term resilience and growth.

Key Questions Answered

What are risk management principles?

Risk management principles are fundamental guidelines that organizations follow to identify, assess, and mitigate risks effectively in various aspects of their operations.

How do risk management principles benefit businesses?

By integrating risk management principles, businesses can enhance decision-making processes, improve operational efficiency, and minimize potential negative impacts on their performance.

Why is risk tolerance important in risk management?

Risk tolerance plays a crucial role in determining how much risk an organization is willing to accept in pursuit of its objectives, guiding strategic decisions and risk mitigation efforts.

What tools are commonly used for risk assessment?

Common tools for risk assessment include SWOT analysis, scenario analysis, risk registers, and risk matrices, which help organizations identify and prioritize risks effectively.

Can risk mitigation plans eliminate all risks?

Risk mitigation plans aim to reduce the likelihood and impact of risks, but it is impossible to eliminate all risks entirely. However, effective strategies can significantly minimize potential negative consequences.