As Risk assessment process takes center stage, this opening passage beckons readers with casual formal language style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

Exploring the steps, importance of stakeholder involvement, and categorization of risks, this topic delves into the core of risk assessment processes.

Risk Assessment Process

Risk assessment is a crucial step in any project or decision-making process to identify potential risks and determine appropriate mitigation strategies. Here, we will explore the steps involved in a typical risk assessment process, how risks are identified and categorized, and the importance of stakeholder involvement.

Steps Involved in Risk Assessment Process

- Identify Risks: The first step in the risk assessment process is to identify potential risks that could negatively impact the project or decision. This involves brainstorming with stakeholders to determine all possible risks.

- Assess Risks: Once risks are identified, they need to be assessed in terms of their likelihood of occurrence and potential impact. This helps prioritize which risks need immediate attention.

- Mitigate Risks: After assessing risks, mitigation strategies need to be developed to reduce the likelihood of the risk occurring or minimize its impact. This may involve implementing preventive measures or contingency plans.

- Monitor and Review: Risk assessment is an ongoing process, and risks need to be continuously monitored and reviewed to ensure that mitigation strategies are effective and new risks are addressed promptly.

Identifying and Categorizing Risks

During the risk assessment process, risks are identified through brainstorming sessions, risk registers, historical data, expert judgment, and other tools. Once identified, risks are categorized based on their nature, such as technical risks, financial risks, legal risks, operational risks, and so on. Categorizing risks helps in better understanding and managing them effectively.

Importance of Stakeholder Involvement

Stakeholder involvement is crucial in the risk assessment process as stakeholders bring different perspectives, expertise, and insights that can help in identifying risks that might have been overlooked. Involving stakeholders also ensures that all potential risks are considered and that mitigation strategies are aligned with the project goals and objectives. Additionally, stakeholder involvement fosters a sense of ownership and accountability, leading to better risk management outcomes.

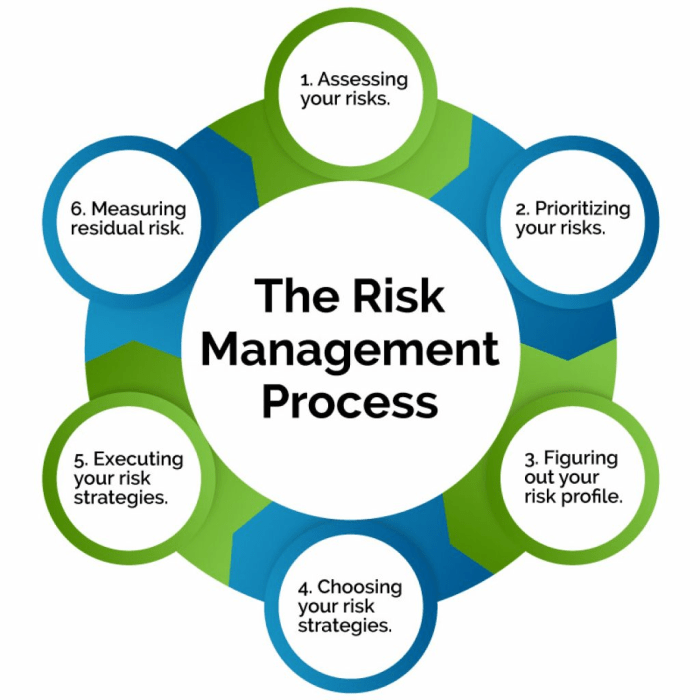

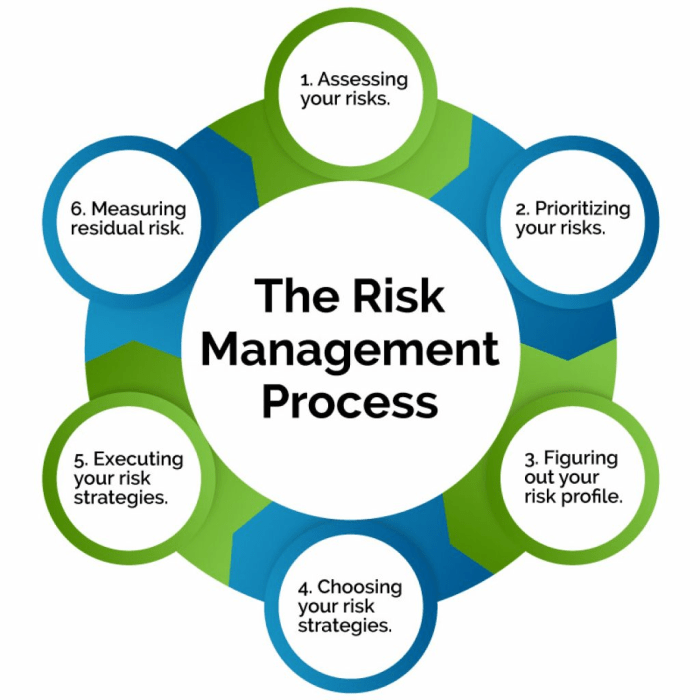

Risk Management

Risk management is the process of identifying, assessing, and prioritizing risks, followed by coordinating and applying resources to minimize, control, and monitor the impact of those risks. It involves developing strategies to manage risks effectively and efficiently.

Differentiating Risk Assessment and Risk Management

Risk assessment is the initial step in the risk management process, focusing on identifying potential risks and evaluating their likelihood and impact. On the other hand, risk management involves taking action to address those risks, including developing plans and strategies to mitigate or eliminate them.

Developing Risk Management Strategies based on Risk Assessment Findings

Once risks have been assessed and prioritized, risk management strategies are developed to address each identified risk. This may involve implementing preventive measures, transferring risk to another party through insurance or contracts, accepting the risk, or avoiding the risk altogether.

Tools and Techniques for Risk Management

- Risk Transfer: Involves transferring the risk to another party through insurance, contracts, or other agreements.

- Risk Avoidance: Involves taking actions to avoid the risk altogether, such as not engaging in a high-risk activity.

- Risk Mitigation: Involves implementing measures to reduce the likelihood or impact of a risk, such as improving security systems or creating backup plans.

- Risk Acceptance: Involves acknowledging the risk and its potential consequences without taking specific action to address it.

- Risk Monitoring: Ongoing process of tracking identified risks and evaluating the effectiveness of risk management strategies.

Risk Tolerance

Risk tolerance refers to the level of risk that an organization or individual is willing to accept in pursuit of its objectives. It is a crucial aspect of risk assessment and management as it helps in determining the acceptable risk levels and guides decision-making processes.

Significance of Risk Tolerance

Risk tolerance plays a vital role in risk assessment and management by providing a clear understanding of the amount of risk that an organization is willing to take on. By defining risk tolerance levels, organizations can set boundaries for risk-taking activities and ensure that they align with their overall objectives and values.

- It helps in prioritizing risks: By establishing risk tolerance levels, organizations can prioritize risks based on their potential impact and likelihood, focusing on those that fall within acceptable limits.

- It guides decision-making: Risk tolerance influences decision-making processes by providing a framework for evaluating risks and determining the appropriate response strategies.

- It enhances risk communication: Clear risk tolerance levels facilitate effective communication within the organization, ensuring that stakeholders are aware of the risks being taken and the rationale behind them.

Determining Risk Tolerance Levels

Risk tolerance levels are determined through a comprehensive assessment of various factors, including the organization’s objectives, risk appetite, regulatory requirements, and stakeholder expectations. This process involves:

- Evaluating risk appetite: Understanding the organization’s risk appetite is essential in setting risk tolerance levels, as it defines the amount of risk that the organization is willing to take on to achieve its goals.

- Assessing risk exposure: Analyzing the organization’s current risk exposure helps in identifying potential risks and their potential impact on the organization’s performance and reputation.

- Considering external factors: External factors such as regulatory changes, market conditions, and stakeholder expectations also influence risk tolerance levels and need to be taken into account.

Relationship with Decision-Making Processes

Risk tolerance directly impacts decision-making processes in risk management by providing a benchmark for evaluating risks and determining the appropriate response strategies. It helps in:

“Balancing risk and reward to achieve organizational objectives effectively.”

Effective risk management requires organizations to align their risk tolerance levels with their overall goals and values, ensuring that risks are managed in a way that maximizes opportunities while minimizing potential threats.

Risk Management Strategies

Risk management strategies play a crucial role in minimizing potential risks and ensuring the smooth operation of businesses across various industries. These strategies involve identifying, assessing, and mitigating risks to protect assets, reputation, and overall business success. Let’s delve into the common risk management strategies used in different sectors and understand the process of selecting and implementing these strategies, along with the importance of regular monitoring and adjustment to reduce overall risk exposure.

Common Risk Management Strategies

- Risk Avoidance: This strategy involves completely avoiding activities that carry high levels of risk, thereby eliminating the possibility of negative outcomes.

- Risk Reduction: By implementing measures to lessen the likelihood or impact of risks, businesses can reduce their exposure to potential threats.

- Risk Transfer: This strategy involves transferring the risk to another party, such as through insurance or outsourcing, to minimize the financial impact on the business.

- Risk Acceptance: Some risks may be deemed acceptable or unavoidable, leading businesses to accept them and focus on managing the consequences effectively.

Selecting and Implementing Risk Management Strategies

When selecting risk management strategies, businesses must first identify the specific risks they face and assess their potential impact. This process involves analyzing the likelihood of occurrence and the severity of consequences associated with each risk. Once identified, businesses can choose the most appropriate strategies based on their risk tolerance and resources.

Implementation of risk management strategies requires clear communication, proper training, and the integration of risk management practices into daily operations. Regular reviews and updates are essential to ensure the effectiveness of these strategies in addressing evolving risks.

Role of Regular Monitoring and Adjustment

- Regular monitoring allows businesses to track the performance of their risk management strategies and identify any emerging risks or changes in the risk landscape.

- Adjustment of strategies based on new information or changing circumstances helps businesses stay proactive in managing risks and adapting to external factors.

- By continuously evaluating and adjusting risk management strategies, businesses can maintain a resilient framework that effectively mitigates risks and safeguards their sustainability.

Summarizing the complexities of risk assessment and management, this discussion sheds light on the key strategies and factors that play a crucial role in minimizing risks effectively.

FAQ Compilation

What are some common risk management strategies?

Common risk management strategies include risk avoidance, risk transfer, risk reduction, and risk acceptance.

How are risk tolerance levels determined within an organization?

Risk tolerance levels are usually determined based on factors such as the organization’s objectives, financial capabilities, and industry standards.

What is the relationship between risk tolerance and decision-making processes in risk management?

Risk tolerance influences decision-making processes by defining the level of risk an organization is willing to accept in pursuit of its goals.