Embark on a journey through the world of risk assessment frameworks, where clarity and structure pave the way for informed decision-making and risk mitigation strategies. As we delve into the components, processes, and strategies, a deeper understanding of risk management unfolds.

This exploration promises to equip you with the necessary knowledge to navigate the complex landscape of risk assessment and emerge with a fortified approach to mitigating potential threats.

Risk Assessment Framework

A risk assessment framework is a structured approach to identifying, assessing, and mitigating risks within an organization or project. It includes various components that help in systematically evaluating potential risks and developing strategies to manage them effectively.

Components of a Risk Assessment Framework

- Identification of Risks: This involves recognizing potential risks that could impact the organization or project.

- Assessment of Risks: Once identified, risks are assessed in terms of their likelihood and impact on operations.

- Risk Mitigation Strategies: Developing plans to address and minimize the impact of identified risks.

- Monitoring and Review: Regularly monitoring and reviewing the effectiveness of risk mitigation strategies.

Examples of Industries Using Risk Assessment Frameworks

Various industries rely on risk assessment frameworks to manage potential threats and uncertainties. Some common examples include:

- Financial Services: Banks, investment firms, and insurance companies use risk assessment frameworks to evaluate market risks, credit risks, and operational risks.

- Healthcare: Hospitals and healthcare facilities implement risk assessment frameworks to ensure patient safety, data security, and regulatory compliance.

- Construction: The construction industry utilizes risk assessment frameworks to identify hazards, prevent accidents, and ensure compliance with safety regulations.

Importance of a Structured Risk Assessment Framework

Having a structured risk assessment framework in place is crucial for organizations to proactively manage risks and safeguard their operations. It helps in:

- Identifying Potential Threats: By systematically assessing risks, organizations can identify potential threats that may impact their objectives.

- Minimizing Losses: Implementing risk mitigation strategies can help minimize financial losses and operational disruptions caused by unforeseen events.

- Enhancing Decision-Making: A structured framework provides valuable insights that enable informed decision-making and resource allocation.

- Compliance and Reputation: Meeting regulatory requirements and demonstrating a commitment to risk management enhances an organization’s reputation and credibility.

Risk Assessment Process

Risk assessment is a crucial step in identifying and managing potential risks within an organization. The process involves several key steps that help in evaluating and mitigating risks effectively.

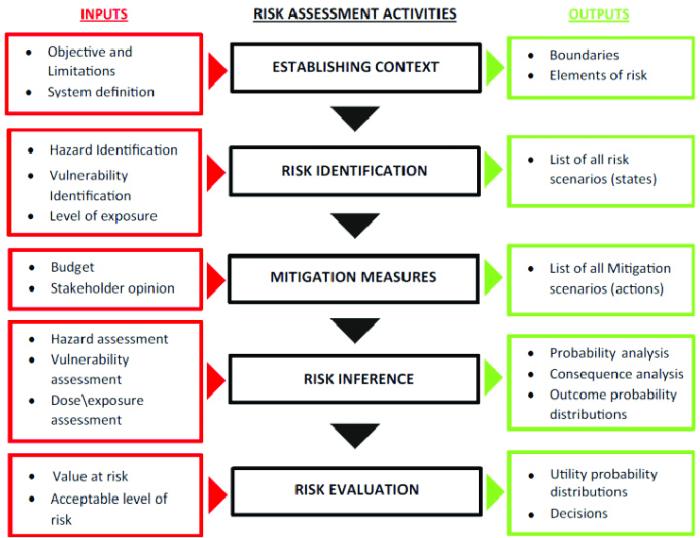

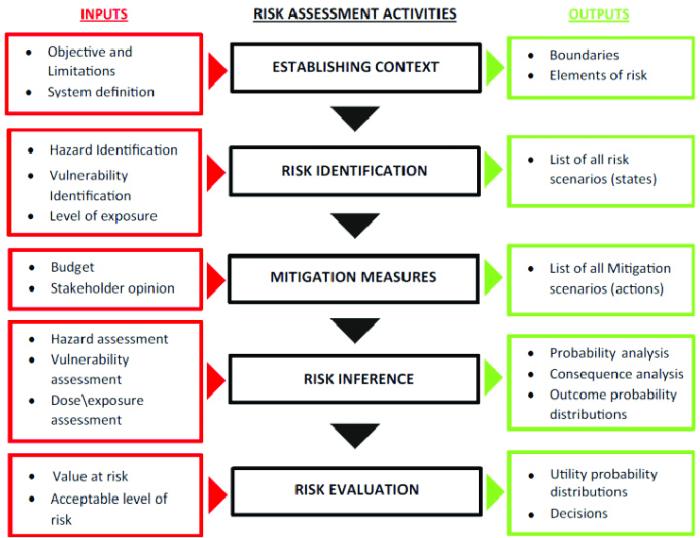

Steps in Risk Assessment

- Identifying Risks: The first step involves identifying potential risks that could impact the organization’s objectives or projects.

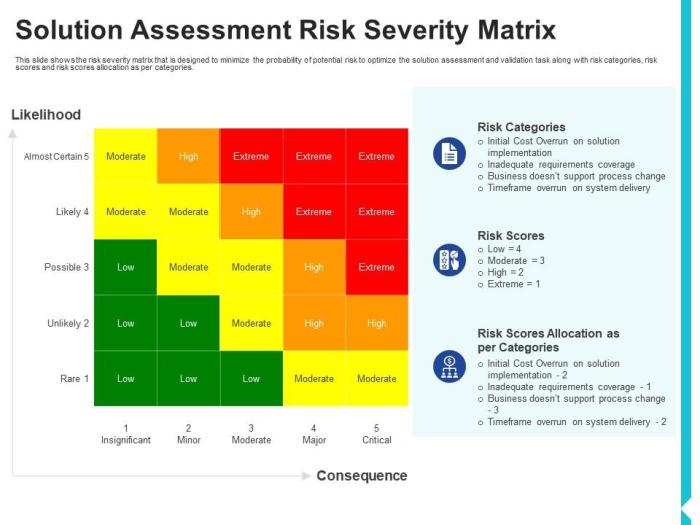

- Assessing Risks: Once risks are identified, they are assessed based on their likelihood and impact on the organization.

- Risk Analysis: In this step, a detailed analysis is conducted to understand the root causes and consequences of each identified risk.

- Risk Evaluation: Risks are then evaluated to prioritize them based on their severity and potential impact.

- Risk Treatment: After prioritizing risks, appropriate treatment strategies are developed to mitigate or manage the risks effectively.

- Monitoring and Review: The final step involves monitoring the implemented risk treatments and regularly reviewing the risk assessment process to ensure its effectiveness.

Role of Stakeholders

Stakeholders play a vital role in the risk assessment process by providing valuable insights, expertise, and perspectives on the potential risks. Their involvement helps in identifying risks more accurately, evaluating them effectively, and developing appropriate risk treatment strategies.

Documentation and Communication of Results

- Risk Register: The results of the risk assessment are typically documented in a risk register, which includes details of identified risks, their likelihood, impact, and treatment strategies.

- Reports: Comprehensive reports are prepared to communicate the risk assessment results to stakeholders, management, and other relevant parties.

- Meetings and Presentations: Meetings and presentations are conducted to discuss the risk assessment findings, treatment plans, and any necessary adjustments or updates.

Risk Management Strategies

To effectively mitigate risks identified through the risk assessment framework, various risk management strategies can be implemented. These strategies aim to reduce the likelihood of potential threats and minimize their impact on the organization.

Proactive vs. Reactive Risk Management Approaches

Proactive risk management involves taking preventive measures to address potential risks before they occur. This approach focuses on identifying and analyzing risks in advance, allowing organizations to implement strategies to avoid or reduce them. On the other hand, reactive risk management responds to risks after they have occurred, focusing on minimizing the damage and recovering from the impacts. While proactive risk management is more strategic and preventive, reactive risk management is more focused on damage control and recovery.

Continuous Monitoring and Reassessment in Risk Management

Continuous monitoring and reassessment are crucial components of effective risk management. By regularly monitoring the risk landscape and reassessing the identified risks, organizations can stay ahead of potential threats and adapt their risk management strategies accordingly. This ongoing process allows for timely adjustments to risk mitigation plans, ensuring that they remain relevant and effective in addressing evolving risks.

Risk Tolerance

Understanding risk tolerance is crucial in the risk assessment process as it helps organizations determine the level of risk they are willing to accept in pursuit of their objectives.

Risk tolerance refers to the degree of uncertainty an organization is willing to withstand in order to achieve its goals. It is often influenced by factors such as industry regulations, financial constraints, and organizational culture.

Determining Risk Tolerance Levels

- Organizations typically assess their risk tolerance by conducting thorough risk assessments that take into account various factors such as the potential impact of risks, likelihood of occurrence, and the organization’s risk appetite.

- Senior management and key stakeholders play a crucial role in setting risk tolerance levels by defining acceptable levels of risk exposure based on the organization’s strategic objectives.

- Risk tolerance can vary across different industries based on industry-specific regulations, market conditions, and the nature of operations.

Influence on Decision-Making

- In the financial industry, risk tolerance directly impacts investment decisions, with investors choosing investment options based on their risk appetite and tolerance levels.

- In the healthcare sector, risk tolerance influences decisions related to patient safety protocols, with hospitals setting risk tolerance levels to ensure the highest standards of care.

- In the technology sector, risk tolerance plays a role in determining the level of innovation and experimentation a company is willing to undertake to stay competitive in the market.

Risk Mitigation

When it comes to risk mitigation, organizations must have a solid plan in place to address the risks identified through the assessment process. By implementing strategies to reduce or eliminate potential threats, businesses can protect their assets, reputation, and overall operations.

Role of Risk Mitigation Plans

Risk mitigation plans play a crucial role in minimizing potential threats by outlining specific actions to be taken in response to identified risks. These plans provide a roadmap for how the organization will address and manage risks effectively, helping to prevent or reduce the impact of adverse events.

Contributions to Organizational Resilience

- Establishing Contingency Plans: Developing contingency plans for various scenarios can help organizations respond quickly and effectively to unexpected events, minimizing disruptions to operations.

- Implementing Security Measures: Investing in robust security measures, such as cybersecurity protocols and physical safeguards, can help protect sensitive data and assets from potential threats.

- Regular Monitoring and Evaluation: Continuously monitoring and evaluating risks allows organizations to identify new threats and adjust mitigation strategies accordingly, ensuring ongoing resilience.

- Training and Awareness Programs: Educating employees on risk management best practices and fostering a culture of risk awareness can help strengthen the organization’s overall resilience.

- Collaboration and Communication: Establishing effective communication channels and fostering collaboration among different departments can enhance the organization’s ability to respond to risks collectively.

In conclusion, the essence of a robust risk assessment framework lies in its ability to fortify organizational resilience and empower decision-makers with the insights needed to navigate uncertainties effectively. By embracing a structured approach to risk evaluation, businesses can proactively address challenges and thrive in dynamic environments.

Popular Questions

What are the key components of a risk assessment framework?

The key components include risk identification, risk analysis, risk evaluation, and risk treatment.

How do organizations determine their risk tolerance levels?

Organizations determine their risk tolerance levels based on factors such as industry regulations, financial stability, and risk appetite.

What role do risk mitigation plans play in minimizing potential threats?

Risk mitigation plans Artikel specific actions to reduce or eliminate risks, thereby reducing the impact of potential threats on the organization.