Diving into the realm of quantitative risk assessment, this introduction sets the stage for a comprehensive exploration of its concepts, components, and methodologies. From its crucial role in risk management to practical applications in various industries, this topic promises to provide valuable insights into evaluating and managing risks with precision.

As we delve deeper, we will uncover the intricate details of quantitative risk assessment, shedding light on its key components, methodologies, and how it influences decision-making processes. By the end of this discussion, you will have a clearer understanding of how quantitative risk assessment plays a pivotal role in shaping risk management strategies.

Overview of Quantitative Risk Assessment

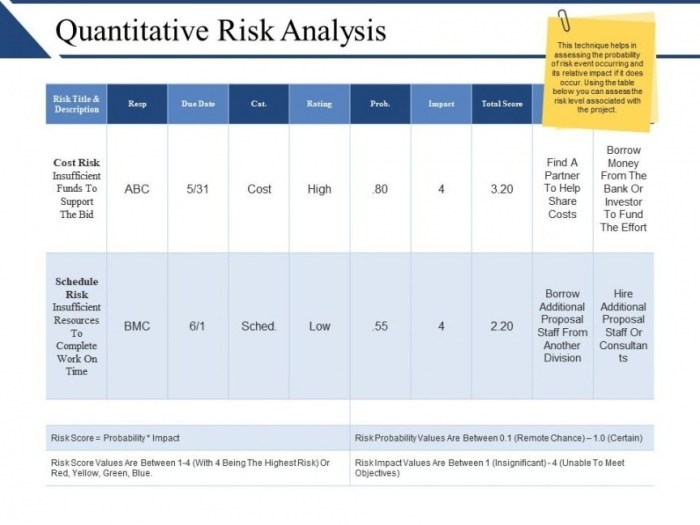

Quantitative Risk Assessment is a systematic process used to evaluate the potential risks associated with a particular project, activity, or decision by assigning numerical values to various risk factors. This approach involves the use of mathematical models and statistical methods to quantify the likelihood of risks occurring and their potential impact on the organization.

Importance of Quantitative Risk Assessment

Quantitative Risk Assessment plays a crucial role in risk management by providing a more precise and objective analysis of risks compared to qualitative methods. It allows organizations to prioritize risks based on their probability and severity, enabling them to allocate resources effectively and make informed decisions to mitigate potential threats.

- Quantitative risk assessment helps organizations in determining the financial impact of potential risks, allowing them to make informed decisions regarding risk treatment strategies.

- It enables organizations to conduct cost-benefit analysis and optimize risk management strategies by identifying the most cost-effective measures to reduce risk exposure.

- By quantifying risks, organizations can improve their risk communication and transparency, enhancing stakeholder confidence and trust in the decision-making process.

Examples of Industries Using Quantitative Risk Assessment

- Insurance: Insurance companies use quantitative risk assessment to determine premiums, assess claims, and manage their overall risk exposure.

- Finance: Banks and financial institutions utilize quantitative risk assessment to evaluate credit risk, market risk, and operational risk to ensure financial stability.

- Construction: Construction companies employ quantitative risk assessment to identify potential hazards, estimate project costs, and enhance safety measures on construction sites.

- Healthcare: Healthcare organizations use quantitative risk assessment to assess patient safety, manage medical errors, and improve quality of care delivery.

Components of Quantitative Risk Assessment

Quantitative risk assessment involves several key components that are essential for a thorough analysis of risks associated with a particular scenario. These components help in quantifying the likelihood and impact of risks, ultimately aiding in making informed decisions to manage and mitigate these risks effectively.

Probability and Consequence Analysis

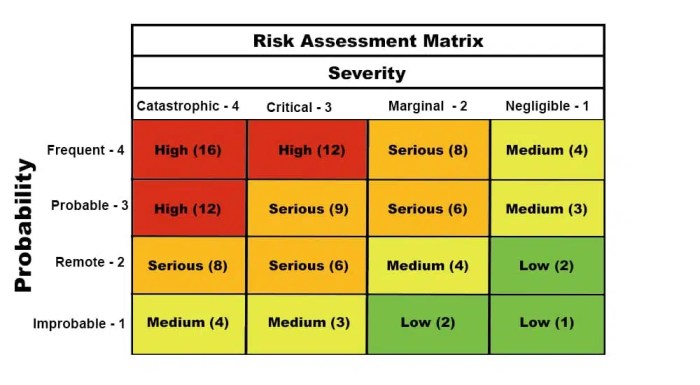

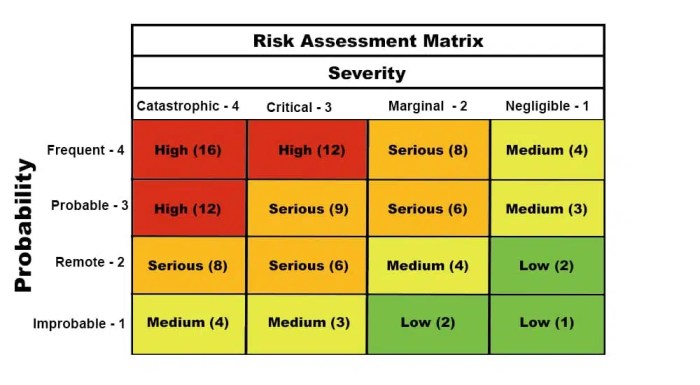

Probability and consequence analysis are fundamental components of quantitative risk assessment. Probability analysis involves assessing the likelihood of various risks occurring based on historical data, expert judgment, and other relevant factors. On the other hand, consequence analysis focuses on evaluating the potential impact or severity of these risks if they were to materialize. By combining these two analyses, organizations can prioritize risks based on their probability and consequences, allowing them to allocate resources efficiently to manage high-risk areas.

- Probability Analysis: This component involves determining the likelihood of different risks occurring, usually expressed in percentages or probabilities. It helps in understanding the chances of a risk event taking place and its potential frequency.

- Consequence Analysis: This component involves assessing the potential impact of risks on various aspects such as financial losses, reputation damage, operational disruptions, and safety hazards. It allows organizations to quantify the severity of each risk scenario.

Data from probability and consequence analysis are crucial inputs for calculating risk metrics such as the risk exposure, risk severity, and risk priority.

Data Analysis and Modeling

Data analysis and modeling play a crucial role in quantitative risk assessment by providing a systematic approach to analyze and interpret information related to risks. These components help in identifying patterns, trends, and correlations within the data, enabling organizations to make more accurate predictions and decisions regarding risk management strategies.

- Data Analysis: This component involves gathering, organizing, and analyzing data related to risks, such as historical incident data, expert opinions, and industry benchmarks. It helps in identifying potential risk factors and assessing their potential impact on the organization.

- Modeling: Modeling techniques such as probabilistic modeling, scenario analysis, and Monte Carlo simulation are used to simulate different risk scenarios and their potential outcomes. These models provide a structured framework for evaluating risks under varying conditions, helping organizations understand the uncertainties associated with their decisions.

Methodologies for Quantitative Risk Assessment

Quantitative risk assessment involves various methodologies to analyze and quantify risks effectively. Let’s explore some of the commonly used methodologies, steps involved, and tools/software utilized in this process.

Comparison of Methodologies

- Monte Carlo Simulation: This method involves running multiple simulations to assess the likelihood of different outcomes based on input variables and their probabilities. It helps in understanding the range of possible results and the probability of each scenario.

- Fault Tree Analysis: Fault tree analysis is a deductive method used to identify potential causes of system failures. It involves creating a graphical representation of events leading to the failure and calculating the probability of the top event occurring.

Steps in Conducting a Quantitative Risk Assessment

- Identify risks and define objectives: Clearly Artikel the scope of the assessment and identify potential risks that could impact the objectives.

- Collect data: Gather relevant data on the likelihood and impact of risks to be analyzed.

- Analyze risks: Use appropriate methodologies to quantify risks and assess their potential impact on the objectives.

- Interpret results: Evaluate the results of the analysis to make informed decisions and develop risk mitigation strategies.

Tools and Software for Quantitative Risk Assessment

There are several tools and software available to facilitate quantitative risk assessment processes, such as:

– @Risk: This software integrates seamlessly with Microsoft Excel to perform Monte Carlo simulations and analyze risks.

– SAP Risk Management: A comprehensive tool that helps in identifying, assessing, and mitigating risks across an organization.

– Fault Tree+ : A software tool specifically designed for fault tree analysis to identify potential system failures and their causes.

Risk Assessment in Risk Management

Risk assessment is a crucial component of the broader risk management process, providing a systematic approach to identifying, analyzing, and evaluating potential risks that could affect an organization’s objectives. Quantitative risk assessment plays a key role in this process by assigning numerical values to risks based on probability and impact, allowing organizations to prioritize and address them effectively.

Relationship between Risk Assessment and Risk Mitigation Strategies

Risk assessment and risk mitigation strategies are closely interconnected in the risk management framework. Once risks have been identified and quantified through quantitative risk assessment, organizations can develop and implement appropriate risk mitigation strategies to reduce the likelihood or impact of these risks. By understanding the relationship between risk assessment and risk mitigation, organizations can proactively manage uncertainties and safeguard their operations.

- Developing contingency plans based on identified risks and their potential impacts.

- Implementing risk transfer mechanisms such as insurance to mitigate financial risks.

- Enhancing internal controls and processes to minimize operational vulnerabilities.

- Regularly monitoring and reviewing risk exposure to adapt mitigation strategies as needed.

Effective risk mitigation strategies are essential for organizations to minimize potential losses and optimize opportunities for sustainable growth.

Quantitative Risk Assessment and Informed Decision-Making

Quantitative risk assessment empowers organizations to make informed decisions about risk tolerance levels by providing a quantitative basis for evaluating risks. By assigning numerical values to risks, organizations can compare, prioritize, and allocate resources to manage risks effectively. This data-driven approach enables decision-makers to assess the potential impact of risks on business objectives and determine the most appropriate risk response strategies.

- Setting risk tolerance thresholds based on acceptable levels of risk exposure.

- Aligning risk management activities with organizational goals and objectives.

- Leveraging quantitative risk assessment results to optimize resource allocation and risk mitigation efforts.

- Enhancing transparency and accountability in decision-making processes related to risk management.

In conclusion, the journey through quantitative risk assessment has highlighted its significance in navigating the complexities of risk management. From analyzing probabilities to modeling potential consequences, this process equips organizations with the tools needed to make informed decisions and mitigate risks effectively. By embracing quantitative risk assessment, businesses can proactively manage uncertainties and enhance their resilience in an ever-evolving landscape of risks and challenges.

Essential FAQs

What is quantitative risk assessment?

Quantitative risk assessment is a method used to evaluate risks by assigning numerical values to various components of risk, such as probability and consequences, to make informed decisions.

How does quantitative risk assessment contribute to risk management?

Quantitative risk assessment provides a systematic approach to identifying, analyzing, and prioritizing risks, allowing organizations to develop effective risk mitigation strategies.

What are some common industries where quantitative risk assessment is applied?

Quantitative risk assessment is commonly used in industries such as finance, healthcare, construction, and environmental management to assess risks associated with financial investments, patient outcomes, project developments, and environmental impacts, respectively.