With Low risk tolerance investments at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling filled with unexpected twists and insights.

In the realm of investments, making choices that align with your risk tolerance is crucial for financial stability. Let’s explore how low-risk investments can offer security and growth opportunities for savvy investors.

Risk Assessment

Risk assessment in the context of investments involves evaluating the potential risks associated with a particular investment opportunity. This process helps investors understand the level of risk they are exposed to and make informed decisions.

Importance of Conducting Risk Assessment

Before making investment decisions, it is crucial to conduct a thorough risk assessment to mitigate potential losses and maximize returns. By assessing risks, investors can identify potential threats to their investment portfolio and take necessary steps to minimize these risks.

- One common tool used for assessing risks in investment opportunities is the risk assessment matrix. This matrix helps investors categorize risks based on their likelihood and impact, allowing them to prioritize and address the most critical risks first.

- Another method is scenario analysis, where investors simulate various scenarios to understand how different factors can affect their investments. By analyzing different scenarios, investors can better prepare for unexpected events and make more informed decisions.

- Furthermore, risk assessment can also involve using historical data, financial models, and expert opinions to evaluate the potential risks associated with an investment opportunity.

How Risk Assessment Helps Investors

Risk assessment provides investors with valuable insights into the potential risks and rewards of an investment opportunity. By understanding the risks involved, investors can make more informed decisions and develop strategies to mitigate these risks effectively.

Ultimately, conducting a thorough risk assessment is essential for investors to protect their capital, optimize their investment returns, and achieve their financial goals.

Risk Management

Risk management plays a crucial role in the investment landscape as it involves identifying, assessing, and mitigating potential risks to protect the capital invested. By effectively managing risks, investors can minimize the impact of adverse events and enhance the overall performance of their investment portfolios.

Common Strategies for Managing Risks

- Diversification: Spreading investments across different asset classes, industries, and geographical regions can help reduce the impact of a downturn in any single investment.

- Asset allocation: Allocating investments based on risk tolerance and investment goals can help balance risk and return potential.

- Stop-loss orders: Setting predefined price levels to automatically sell an investment if it reaches a certain point can help limit losses.

- Hedging: Using derivatives or other financial instruments to offset potential losses in a particular investment can help protect the portfolio.

Real-World Examples of Successful Risk Management

During the 2008 financial crisis, investors who had diversified portfolios with a mix of stocks, bonds, and cash equivalents were better positioned to weather the storm compared to those heavily invested in a single asset class.

Role of Diversification in Risk Management

Diversification is a key strategy for managing risks, especially for investors with low risk tolerance. By spreading investments across various assets, investors can reduce the impact of market volatility on their portfolios. For example, having a mix of stocks, bonds, and cash equivalents can help cushion against losses in any single asset class, providing a more stable and predictable investment experience.

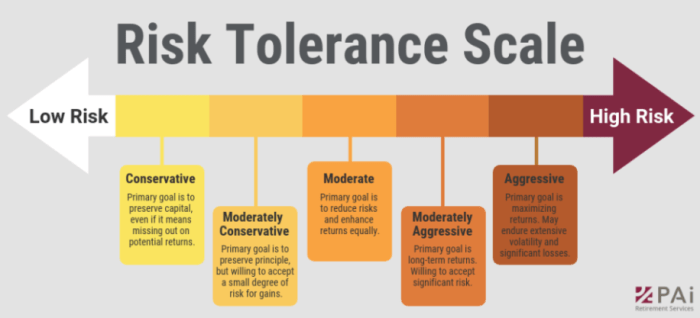

Risk Tolerance

Risk tolerance refers to an individual’s ability and willingness to endure fluctuations in the value of their investments. It plays a crucial role in shaping one’s investment decisions, as it determines the level of risk one is comfortable with in pursuit of potential returns.

Factors Influencing Risk Tolerance

- Financial Goals: The specific objectives a person has for their investments can greatly impact their risk tolerance. Short-term goals may require lower risk investments, while long-term goals may allow for higher risk options.

- Time Horizon: The length of time an individual plans to hold their investments can influence their risk tolerance. Longer time horizons may permit more risk-taking, as there is more time to recover from potential losses.

- Financial Situation: Personal financial circumstances, including income, savings, and other investments, can affect one’s risk tolerance. Those with stable financial situations may be more willing to take on risk.

Aligning Investment Choices with Risk Tolerance

- It is essential to ensure that the level of risk in your investment portfolio matches your risk tolerance. Diversifying investments across various asset classes can help manage risk while potentially maximizing returns.

- Regularly reassessing your risk tolerance and adjusting your investment strategy accordingly is crucial to maintaining a balanced portfolio that aligns with your financial goals.

Tips for Assessing Risk Tolerance

- Utilize risk tolerance questionnaires provided by financial institutions or investment platforms to gauge your comfort level with risk.

- Consider your emotional response to market fluctuations and volatility, as this can provide insight into your risk tolerance.

- Consult with a financial advisor to help evaluate your risk tolerance and determine suitable investment options that align with your comfort level.

Low-Risk Tolerance Investments

When it comes to investing, individuals with low-risk tolerance prefer to prioritize capital preservation over high returns. This risk-averse approach leads them to seek out investment options that offer stability and security, even if it means sacrificing potential growth opportunities.

Common Investment Options

- Bonds: Bonds are debt securities issued by governments, municipalities, or corporations. They are considered low-risk investments because they offer a fixed interest rate and return of principal at maturity.

- Certificates of Deposit (CDs): CDs are time deposits offered by banks with fixed terms and interest rates. They are insured by the FDIC up to a certain limit, making them a secure option for risk-averse investors.

- Index Funds: Index funds are mutual funds that passively track a specific market index, such as the S&P 500. They offer diversification and low fees, making them a popular choice for conservative investors.

Potential Returns and Risks

- While low-risk investments like bonds, CDs, and index funds provide stability and security, they typically offer lower returns compared to higher-risk investments like stocks or real estate.

- Investors with low-risk tolerance are willing to accept lower returns in exchange for reduced volatility and the preservation of their capital.

- However, it’s important to note that even low-risk investments carry some level of risk, such as inflation risk or interest rate risk, which can impact the overall returns.

Diversified Portfolio Considerations

- Building a diversified portfolio with low-risk investments involves spreading out your investments across different asset classes to minimize risk.

- By combining bonds, CDs, index funds, and other low-risk options, investors can achieve a balanced portfolio that offers stability and potential growth opportunities.

- It’s essential to regularly review and rebalance your portfolio to ensure it aligns with your risk tolerance and financial goals.

In conclusion, navigating the world of low-risk investments requires a blend of caution and strategy. By understanding your risk tolerance and choosing the right investment options, you can build a stable financial future with peace of mind.

FAQs

What are some common low-risk investment options?

Common low-risk investment options include bonds, CDs, and index funds, which offer stable returns with minimal risk.

How does risk tolerance influence investment decisions?

Risk tolerance influences investment decisions by guiding individuals to choose options that align with their comfort level regarding potential risks and rewards.

Why is diversification important for managing risks in low-risk investments?

Diversification helps spread risks across different assets, reducing the impact of potential losses in any single investment and enhancing overall portfolio stability.