Embark on a journey into the realm of Risk tolerance and decision-making, where the intricacies of assessing risks and making informed choices unfold before your eyes.

Explore the nuances of risk management, risk tolerance, and decision-making processes that shape our actions and outcomes.

Risk Assessment

Risk assessment is a crucial step in the decision-making process as it involves evaluating potential risks and uncertainties associated with different options. By identifying and analyzing risks, individuals or organizations can make more informed choices that align with their objectives and values.

Tools and Methods for Risk Assessment

- Probability and Impact Matrix: This tool helps in assessing the likelihood of risks occurring and their potential impact on the desired outcomes.

- SWOT Analysis: Strengths, Weaknesses, Opportunities, and Threats analysis can help in identifying internal and external factors that may pose risks to a decision.

- Decision Trees: Visual representations of decision options and their potential outcomes can aid in understanding the risks associated with each choice.

Importance of Identifying and Analyzing Risks

- Minimizing Losses: By identifying risks beforehand, decision-makers can take steps to mitigate or avoid potential losses.

- Improving Decision Quality: Understanding risks allows for the selection of options that offer the best balance of benefits and drawbacks.

- Enhancing Preparedness: Analyzing risks helps in developing contingency plans to address unexpected outcomes or events.

Role of Risk Assessment in Understanding Potential Outcomes

Risk assessment provides a clearer picture of the potential consequences of each decision option. By considering different scenarios and their associated risks, individuals or organizations can anticipate challenges and plan accordingly to achieve their desired goals.

Risk Management

Effective risk management is crucial in ensuring the success and sustainability of any organization. By implementing various strategies to identify, assess, and mitigate risks, businesses can protect themselves from potential threats and capitalize on opportunities.

Different Strategies for Managing Risks Effectively

There are several strategies that organizations can employ to manage risks effectively:

- Risk Avoidance: This strategy involves avoiding activities that could lead to potential risks altogether.

- Risk Reduction: Organizations can take steps to reduce the likelihood or impact of risks through preventive measures.

- Risk Transfer: Transferring risks to third parties, such as insurance companies, can help mitigate the financial impact of unexpected events.

- Risk Acceptance: Some risks may be deemed acceptable and can be managed by having contingency plans in place.

Key Components of a Risk Management Plan

A comprehensive risk management plan should include the following key components:

- Risk Identification: Identifying and categorizing potential risks that could impact the organization.

- Risk Assessment: Evaluating the likelihood and potential impact of each identified risk.

- Risk Mitigation: Developing and implementing strategies to reduce or eliminate risks.

- Monitoring and Review: Regularly monitoring the effectiveness of risk management strategies and adjusting as needed.

Proactive versus Reactive Approaches to Risk Management

Proactive risk management involves anticipating potential risks and taking preventive measures to mitigate them before they occur. On the other hand, reactive risk management involves responding to risks as they arise, often resulting in higher costs and damages. Proactive approaches are generally more effective in minimizing negative impacts on decision-making.

Role of Risk Management in Minimizing Negative Impacts on Decision-Making

Risk management plays a critical role in decision-making by providing a structured approach to identifying, assessing, and managing risks. By integrating risk management into the decision-making process, organizations can make informed choices that consider potential risks and their impact on the desired outcomes. This helps minimize negative impacts and improves the overall effectiveness of decision-making.

Risk Tolerance

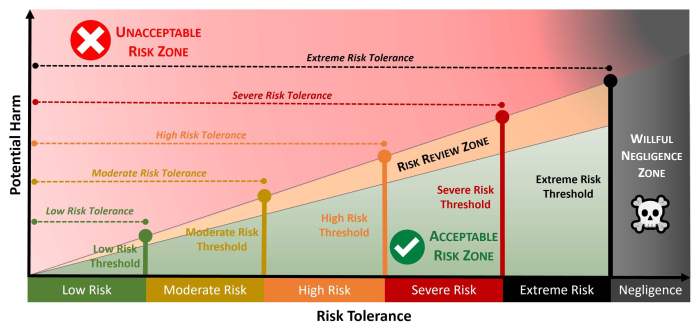

Risk tolerance refers to the degree of uncertainty an individual or organization is willing to accept in the pursuit of their objectives. It plays a crucial role in decision-making processes as it helps determine the level of risk that can be taken on without jeopardizing the desired outcomes.

How to Determine Risk Tolerance Levels

Determining risk tolerance involves assessing factors such as financial capacity, time horizon, investment goals, and emotional willingness to withstand market fluctuations. Individuals can use risk tolerance questionnaires or seek professional advice to better understand their risk tolerance levels.

Examples of Risk Tolerance in Decision-Making

- An individual with a high risk tolerance may choose to invest in volatile stocks in hopes of higher returns, while someone with a low risk tolerance may opt for safer investments like bonds.

- An organization with a high risk tolerance may pursue aggressive growth strategies, such as entering new markets, while a conservative organization may focus on maintaining stability and consistent returns.

Relationship between Risk Tolerance and Overall Risk Management

Risk tolerance directly influences the risk management strategies implemented by individuals and organizations. By aligning risk tolerance levels with risk management practices, stakeholders can make informed decisions that balance risk and reward effectively.

Decision-Making

Risk tolerance plays a crucial role in decision-making processes, shaping how individuals or organizations evaluate and respond to potential risks. The level of risk one is willing to accept can significantly influence the choices made in various situations.

Impact of Risk Assessment on Decision-Making

Risk assessment directly impacts the quality of decision-making by providing a structured evaluation of potential risks. By thoroughly analyzing and identifying risks, decision-makers can make more informed choices, considering both the likelihood of risks occurring and their potential impact.

- Establish a systematic approach to assess risks, considering both internal and external factors.

- Utilize risk assessment tools and techniques to quantify and prioritize risks based on their severity and likelihood.

- Regularly review and update risk assessments to adapt to changing circumstances and new information.

Tips for Making Informed Decisions with Risk Factors

When faced with decisions involving risk, it is essential to adopt a strategic approach that balances potential benefits and drawbacks. Here are some tips for making informed decisions while considering risk factors:

- Evaluate the potential consequences of each decision, weighing the risks against the rewards.

- Seek input from relevant stakeholders or experts to gain different perspectives on the risks involved.

- Implement risk mitigation strategies to minimize the impact of potential risks on the decision outcome.

Role of Intuition vs. Data-Driven Approaches in Decision-Making

In decision-making under uncertainty, individuals may rely on intuition or data-driven approaches to guide their choices. While intuition can provide quick insights based on past experiences and gut feelings, data-driven approaches offer a more systematic and evidence-based way to analyze risks and outcomes.

It is essential to strike a balance between intuition and data-driven analysis to make well-informed decisions that consider both subjective insights and objective information.

As we conclude our exploration of Risk tolerance and decision-making, remember that understanding and managing risks play a pivotal role in shaping our path forward.

Q&A

What is risk tolerance?

Risk tolerance refers to the level of risk an individual or organization is willing to accept in decision-making processes.

How can one determine their risk tolerance level?

Individuals can determine their risk tolerance by assessing their financial goals, time horizon, and comfort with uncertainty.

What is the role of risk assessment in decision-making?

Risk assessment helps in identifying and analyzing potential risks, allowing for informed decision-making based on possible outcomes.

What are proactive and reactive approaches to risk management?

Proactive risk management involves taking preventive measures, while reactive risk management responds to risks as they arise.