Diving into Risk tolerance in business, this introduction sets the stage for a comprehensive exploration of how businesses navigate risks and make crucial decisions, shedding light on the intricate balance between risk and reward. From the fundamental concept of risk tolerance to real-world examples of its impact on decision-making, this overview will provide valuable insights into the dynamic landscape of risk management in the business world.

Risk Tolerance in Business

Risk tolerance in business refers to the level of uncertainty or potential loss that a company is willing to withstand in pursuit of its goals and objectives. It involves assessing the risks associated with various decisions and actions and determining the amount of risk that the business can afford to take.

Importance of Understanding Risk Tolerance

Understanding risk tolerance is crucial for businesses as it helps in making informed decisions and aligning strategies with the company’s risk appetite. By knowing how much risk the business can handle, leaders can avoid unnecessary exposure and protect the organization from potential threats.

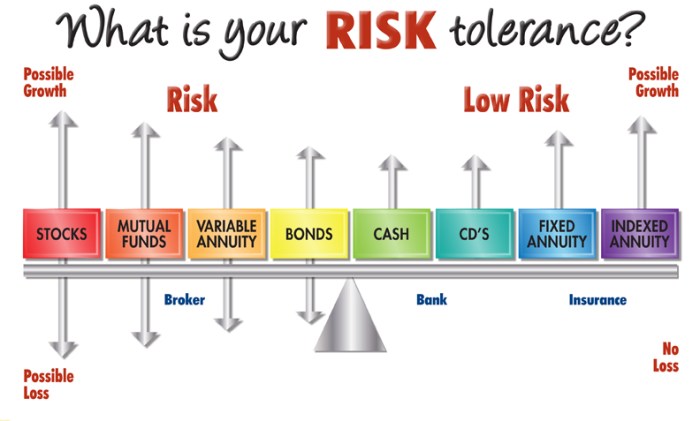

- It guides investment decisions: A business with a high risk tolerance may be more inclined to invest in innovative but risky ventures, while a conservative company may opt for safer investments.

- It influences strategic planning: Risk tolerance plays a key role in determining the direction and scope of business strategies. Companies with a low risk tolerance may focus on incremental growth, while those with a high risk tolerance may pursue aggressive expansion.

- It impacts resource allocation: Understanding risk tolerance helps businesses allocate resources effectively, ensuring that capital, time, and effort are directed towards initiatives that align with the company’s risk profile.

Factors Influencing Risk Tolerance

In business, risk tolerance is influenced by various factors that can impact decision-making and strategic planning. These factors can be categorized into internal and external influences, as well as industry trends that play a significant role in determining a company’s risk appetite.

Internal Factors

Internal factors such as the company’s financial position, management structure, and corporate culture can greatly influence risk tolerance. For instance, a financially stable company with strong leadership may be more willing to take on higher risks compared to a company facing financial challenges or with a conservative management approach. The risk appetite of employees and stakeholders also contributes to the overall risk tolerance of the organization.

External Factors

External factors like market conditions, regulatory environment, and competitive landscape can impact a company’s risk tolerance. In a volatile market with intense competition, businesses may need to adjust their risk tolerance levels to remain competitive and adapt to changing circumstances. Regulatory requirements and compliance standards also play a crucial role in determining how much risk a company can afford to take.

Industry Trends

Industry trends can significantly affect risk tolerance levels within a specific sector. For example, emerging technologies or disruptive innovations may compel companies to take on more risks to stay ahead of the curve and capitalize on new opportunities. On the other hand, industries facing decline or saturation may exhibit lower risk tolerance as companies focus on stability and sustainability rather than growth.

Risk Assessment

Risk assessment in the context of business involves identifying, analyzing, and evaluating potential risks that could impact the organization’s objectives, projects, or operations. It is a systematic process that helps businesses understand the likelihood and impact of risks, allowing them to make informed decisions on how to manage and mitigate these risks effectively.

Conducting a Risk Assessment

- Identify the risks: Begin by identifying all potential risks that could affect the business, including internal and external factors.

- Analyze the risks: Assess the likelihood and impact of each risk to determine the level of risk exposure.

- Evaluate the risks: Prioritize risks based on their significance and develop strategies to manage or mitigate them.

- Monitor and review: Regularly review and update the risk assessment to ensure it remains relevant and effective.

Importance of Regular Risk Assessments for Businesses

Regular risk assessments are crucial for businesses to:

- Proactively identify and address potential threats to the organization.

- Enhance decision-making by considering risks and opportunities in strategic planning.

- Improve operational efficiency by minimizing disruptions and losses caused by unforeseen events.

- Demonstrate a commitment to risk management and compliance with regulations.

Risk Management Strategies

Risk management is a crucial aspect of business operations, as it allows companies to anticipate and mitigate potential risks that could impact their success. There are various risk management strategies that businesses can implement to protect their assets and ensure long-term stability. In this section, we will explore some successful risk management practices and discuss the role of technology in modern risk management.

Diversification

Diversification is a common risk management strategy that involves spreading investments across different assets or markets to reduce overall risk. By diversifying their portfolio, businesses can minimize the impact of a single event or market fluctuation on their financial health. For example, a company operating in multiple countries can offset losses in one market with gains in another, reducing the overall risk exposure.

Insurance

Insurance is another important risk management tool that businesses can utilize to protect themselves against unforeseen events. By purchasing insurance policies for various risks such as property damage, liability, or business interruption, companies can transfer the financial burden of these risks to an insurance provider. This helps businesses mitigate the impact of potential losses and ensures continuity of operations in case of an unexpected event.

Risk Avoidance

Risk avoidance is a strategy where businesses choose to completely avoid certain risks that they deem too costly or harmful to their operations. This could involve steering clear of high-risk investments, partnerships, or activities that could jeopardize the company’s reputation or financial stability. While risk avoidance may limit potential opportunities, it can also protect businesses from catastrophic losses.

Technology in Risk Management

Technology plays a vital role in modern risk management practices, allowing companies to leverage data analytics, artificial intelligence, and automation to enhance their risk assessment and mitigation efforts. For example, predictive analytics can help businesses identify potential risks before they occur, enabling proactive risk management strategies. Additionally, risk management software can streamline processes, improve decision-making, and provide real-time insights into the company’s risk exposure.

In conclusion, Risk tolerance in business is not just about tolerating risks—it’s about understanding them, assessing their implications, and implementing effective strategies to mitigate potential threats. By embracing a proactive approach to risk management, businesses can not only safeguard their operations but also seize opportunities for growth and innovation in an ever-evolving marketplace.

FAQ Resource

What role does risk tolerance play in business decision-making?

Risk tolerance influences how businesses weigh potential risks against rewards when making strategic decisions, guiding their approach to uncertainty and volatility in the market.

How can businesses enhance their risk tolerance levels?

Businesses can enhance their risk tolerance by diversifying their investments, conducting thorough risk assessments, and fostering a culture of adaptability and resilience within their organizations.

Why is it essential for businesses to regularly conduct risk assessments?

Regular risk assessments help businesses identify potential threats, evaluate their impact on operations, and proactively implement risk management strategies to mitigate vulnerabilities and capitalize on opportunities.