Exploring the concept of risk tolerance assessment provides valuable insights into how individuals approach financial decisions and navigate uncertainties. From determining risk preferences to aligning strategies with goals, this process plays a crucial role in shaping investment choices.

Understanding the factors that influence risk tolerance and the tools used for assessment can empower investors to make informed choices tailored to their unique circumstances.

Risk Tolerance Assessment

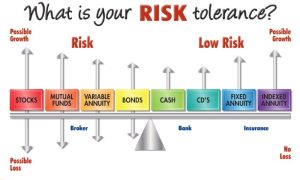

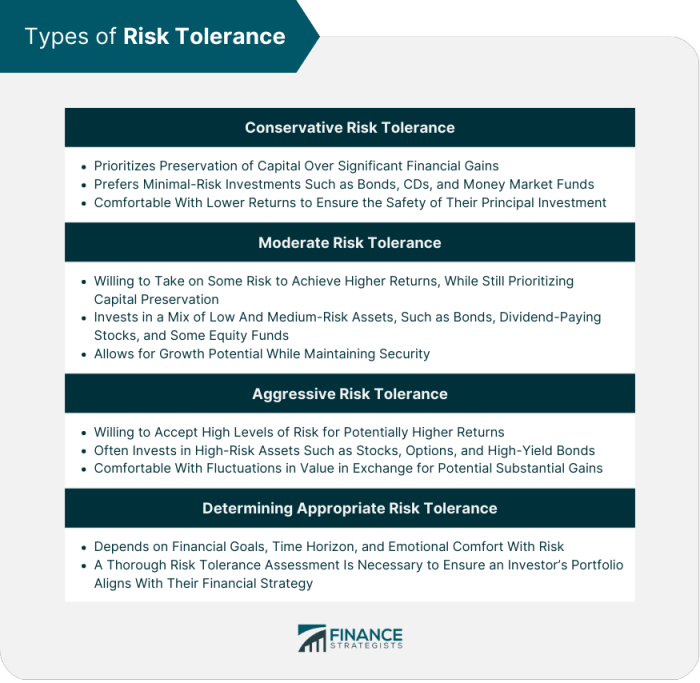

Risk tolerance in financial planning refers to an individual’s willingness and ability to endure fluctuations in the value of their investments in pursuit of potentially higher returns.

Importance of Conducting a Risk Tolerance Assessment

Assessing risk tolerance is crucial for investors as it helps in aligning investment choices with their financial goals, time horizon, and psychological comfort level.

Factors Influencing an Individual’s Risk Tolerance

- Financial Goals: Short-term vs. long-term objectives can impact risk tolerance.

- Time Horizon: Longer time horizons may lead to higher risk tolerance.

- Psychological Factors: Personal experiences and emotions can influence risk tolerance.

- Financial Knowledge: Understanding of investments may affect risk tolerance levels.

Tools and Questionnaires for Assessing Risk Tolerance

There are various tools and questionnaires available to help determine an individual’s risk tolerance level:

- Questionnaires: Often used to gauge an investor’s comfort level with market volatility.

- Robo-Advisors: Online platforms that use algorithms to assess risk tolerance based on responses to specific questions.

- Professional Financial Advisors: Work closely with clients to understand their risk tolerance through in-depth conversations.

Risk Assessment

Risk assessment is a crucial process that helps organizations evaluate potential risks and their impact on various aspects of their operations. It involves identifying, analyzing, and prioritizing risks to develop effective strategies for risk management.Differentiate between risk tolerance and risk assessment:Risk tolerance refers to the level of risk that an organization or individual is willing to accept in pursuit of their objectives.

It is a subjective measure that varies based on factors such as risk appetite, financial capacity, and organizational goals. On the other hand, risk assessment is a systematic process of identifying, analyzing, and evaluating risks to determine their potential impact on an organization’s operations.Explain the process of conducting a risk assessment in various industries:The process of conducting a risk assessment typically involves the following steps:

1. Identifying potential risks

This step involves identifying internal and external risks that could impact an organization’s operations.

2. Analyzing risks

Once risks are identified, they are analyzed to assess their likelihood of occurrence and potential impact.

3. Evaluating risks

Risks are then evaluated based on their severity and likelihood to prioritize them for mitigation.

4. Developing risk mitigation strategies

Based on the evaluation, organizations develop strategies to mitigate the identified risks.

5. Monitoring and reviewing

Risk assessments are an ongoing process that requires continuous monitoring and review to ensure the effectiveness of risk mitigation strategies.Discuss the types of risks that are typically assessed in a risk assessment:Common types of risks assessed in a risk assessment include:

Financial risks

Such as market volatility, credit risks, and liquidity risks.

Operational risks

Including supply chain disruptions, technology failures, and regulatory compliance issues.

Strategic risks

Such as competition, changes in market dynamics, and reputation risks.

Compliance risks

Risks related to non-compliance with laws and regulations.

Reputational risks

Risks that could damage an organization’s reputation and brand image.Share examples of risk assessment frameworks or methodologies:Some common risk assessment frameworks and methodologies include:

Failure Mode and Effects Analysis (FMEA)

A structured approach to identifying and mitigating potential failures in a process or system.

SWOT analysis

Assessing an organization’s strengths, weaknesses, opportunities, and threats to identify potential risks.

COSO ERM framework

A comprehensive framework for enterprise risk management that focuses on internal controls, risk assessment, and risk response.

Risk assessment is a critical process that helps organizations proactively manage potential risks to achieve their objectives effectively.

Risk Management

Risk management is the process of identifying, assessing, and prioritizing risks followed by the coordinated application of resources to minimize, monitor, and control the probability and/or impact of unfortunate events. It is a crucial aspect of any organization as it helps in mitigating potential risks that could impact the achievement of objectives.

Key Components of an Effective Risk Management Strategy

An effective risk management strategy typically includes the following key components:

- Identification of Risks: Recognizing and documenting potential risks that could affect the organization.

- Assessment of Risks: Evaluating the likelihood and impact of identified risks on the organization.

- Risk Mitigation: Implementing measures to reduce the probability or impact of risks.

- Monitoring and Control: Regularly monitoring and controlling risks to ensure the effectiveness of mitigation measures.

- Communication: Ensuring clear communication of risks and mitigation strategies to stakeholders.

Variation of Risk Management Practices Across Industries

Risk management practices can vary significantly across different sectors or industries based on the nature of the business, regulatory requirements, and the level of risk tolerance. For example, industries such as finance and healthcare may have more stringent risk management practices due to the sensitivity of data and the potential impact of failures. On the other hand, industries like technology and retail may focus more on innovation and agility in risk management.

Examples of Successful Risk Management Practices

One notable example of successful risk management practices is the case of Toyota Motor Corporation. Toyota implemented a robust risk management system that enabled the company to identify and address potential quality issues in its vehicles promptly, leading to improved customer satisfaction and brand reputation. Another example is the financial services industry, where banks and financial institutions have stringent risk management frameworks to ensure compliance with regulations and safeguard against market volatility.

Risk Tolerance vs. Risk Appetite

When it comes to managing risks in business, understanding the difference between risk tolerance and risk appetite is crucial. While both concepts are related to the level of risk an organization is willing to take, they have distinct roles in decision-making processes.Risk tolerance refers to the amount of risk a company can withstand before it starts to feel uncomfortable or experiences significant negative impacts.

It is essentially the ‘pain threshold’ for risk exposure. On the other hand, risk appetite is the amount of risk a company is willing to take in pursuit of its strategic objectives. It reflects the organization’s willingness to take risks to achieve its goals.

Influence on Decision-Making Processes

Influence on Decision-Making Processes:

- Risk Tolerance: Organizations with a low risk tolerance will be more conservative in their decision-making, opting for safer options even if they offer lower returns. On the contrary, those with a high risk tolerance may be more inclined to take bold moves and pursue high-risk, high-reward opportunities.

- Risk Appetite: A company’s risk appetite directly affects the type of opportunities it pursues. A high-risk appetite may lead to aggressive growth strategies, while a low-risk appetite may result in a more cautious approach to expansion and innovation.

Aligning with Strategic Goals

Aligning with Strategic Goals:

- Organizations need to align their risk tolerance and risk appetite with their overall strategic goals to ensure that risk-taking decisions are in line with their long-term objectives. This alignment helps in avoiding conflicts between risk management practices and strategic direction.

- By clearly defining risk thresholds and risk-taking boundaries, companies can ensure that their risk tolerance and risk appetite support rather than hinder their strategic initiatives.

Measurement and Management

Measurement and Management:

- Risk tolerance and risk appetite can be measured through various quantitative and qualitative methods, including risk assessment surveys, scenario analysis, stress testing, and risk profiling tools.

- Once measured, organizations can manage their risk tolerance and risk appetite by establishing risk limits, monitoring key risk indicators, and regularly reviewing and updating their risk management strategies.

In conclusion, risk tolerance assessment serves as a cornerstone in the realm of financial planning, offering a roadmap for individuals to understand and manage risk effectively. By recognizing one’s risk profile and aligning strategies accordingly, investors can navigate the complexities of the market with confidence and purpose.

Questions and Answers

What is the significance of risk tolerance assessment?

Risk tolerance assessment helps individuals understand their comfort levels with risk and make informed investment decisions based on their unique preferences.

How do factors like age and financial goals influence risk tolerance?

Factors such as age and financial objectives can influence risk tolerance, with younger individuals often having higher risk tolerance due to a longer investment horizon.

Is risk tolerance the same as risk appetite?

Risk tolerance refers to an individual’s willingness to take risks, while risk appetite relates to the level of risk a person or organization is willing to accept in pursuit of their goals.