Beginning with Risk management strategies, the narrative unfolds in a compelling and distinctive manner, drawing readers into a story that promises to be both engaging and uniquely memorable.

Risk management is a crucial aspect of any business operation, ensuring that potential risks are identified, assessed, and effectively mitigated. In this discussion, we will delve into the key strategies and concepts essential for successful risk management.

Risk Assessment

Risk assessment is a crucial step in the risk management process. It involves identifying, analyzing, and evaluating potential risks that could affect an organization’s objectives. By assessing risks, organizations can make informed decisions on how to mitigate or transfer them, ultimately reducing the impact of uncertainties on their operations.

Importance of Identifying and Analyzing Risks

Risk assessment is essential as it helps organizations understand the potential threats they face and their likelihood of occurrence. By identifying and analyzing risks, companies can proactively implement strategies to minimize their impact and protect their assets. Without proper risk assessment, organizations may be caught off guard by unexpected events, leading to financial losses, reputation damage, or even business failure.

- One common tool used for risk assessment is the Risk Matrix, which categorizes risks based on their likelihood and impact. This helps prioritize which risks require immediate attention.

- Another technique is the SWOT analysis, which examines an organization’s strengths, weaknesses, opportunities, and threats to identify potential risks that may arise from internal or external factors.

- Scenario analysis is also a valuable method for assessing risks by creating hypothetical scenarios to evaluate the impact of different events on the organization.

Risk Management

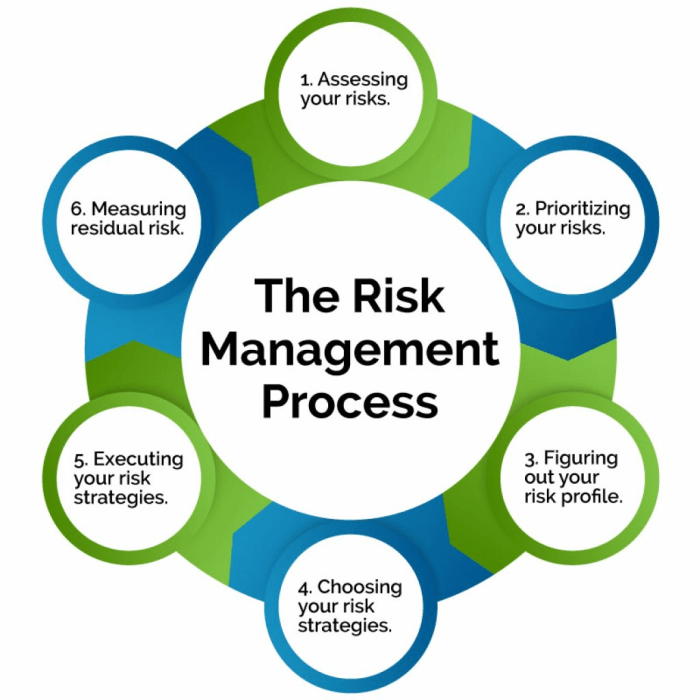

Risk management is the process of identifying, assessing, and prioritizing risks in order to minimize, control, and monitor the impact of uncertain events on business operations. It is a crucial aspect of running a successful business as it helps organizations anticipate potential threats and take proactive measures to mitigate them.

Types of Risk Management Strategies

Risk management strategies can be categorized into various approaches to effectively deal with different types of risks. Some common strategies include:

- Risk Avoidance: This strategy involves eliminating activities or exposures that could lead to potential risks. For example, a company may choose not to invest in a volatile market to avoid financial losses.

- Risk Mitigation: This strategy focuses on reducing the impact or likelihood of risks. Implementing safety protocols, conducting regular maintenance checks, or diversifying investments are examples of risk mitigation strategies.

- Risk Transfer: This strategy involves transferring the financial responsibility of risks to another party, such as through insurance policies or outsourcing certain operations to third-party vendors.

Real-World Scenarios

Effective risk management strategies have played a crucial role in the success of many businesses. For instance, a manufacturing company that implemented strict quality control measures was able to identify and rectify potential product defects before they reached the market, thus avoiding costly recalls and maintaining customer trust.

Risk Tolerance

Risk tolerance refers to the degree of risk that an individual or organization is willing to withstand in the pursuit of their objectives. It plays a crucial role in decision-making processes, especially when it comes to investments or strategic planning. Understanding risk tolerance helps in determining the appropriate level of risk that can be taken on without jeopardizing the overall goals.

Variability Across Industries

Different industries or sectors have varying levels of risk tolerance based on their specific characteristics and business models. For example, industries such as technology or biotech are known for having a higher risk tolerance due to the nature of their operations and the potential for high returns. On the other hand, industries like utilities or consumer goods tend to have lower risk tolerance as they prioritize stability and consistent returns over high-risk investments.

- Technology Sector: Companies in this sector often have a high risk tolerance as they focus on innovation and growth, accepting the possibility of failure in exchange for potential breakthroughs.

- Finance Sector: Financial institutions tend to have a moderate risk tolerance, balancing the need for growth with the importance of stability and regulatory compliance.

- Healthcare Sector: Healthcare companies typically have a lower risk tolerance due to the stringent regulations, long development cycles, and ethical considerations involved in the industry.

Influence on Investment Choices

Risk tolerance plays a significant role in shaping investment decisions, guiding investors towards opportunities that align with their comfort level regarding risk. Investors with a high risk tolerance may opt for aggressive investment strategies such as investing in emerging markets or high-growth stocks. On the contrary, investors with a low risk tolerance may choose more conservative options like bonds or blue-chip stocks to minimize potential losses.

Understanding risk tolerance is essential for making informed decisions and managing risks effectively in various industries and sectors.

Risk Mitigation

In risk management, risk mitigation refers to the process of identifying, assessing, and taking steps to reduce or eliminate the impact of potential risks on a business or project. By implementing various risk mitigation techniques, organizations can increase their resilience and adaptability to unforeseen events.

Proactive Risk Mitigation Strategies

Proactive risk mitigation strategies involve taking preventive measures to reduce the likelihood of risks occurring. This can include implementing policies and procedures, conducting regular risk assessments, investing in technology to enhance security, and training employees to recognize and respond to potential risks. By addressing risks before they escalate, organizations can minimize the impact on their operations and reputation.

- Implementing robust cybersecurity measures to protect against data breaches and cyber attacks.

- Diversifying the supply chain to reduce dependence on a single vendor or supplier.

- Developing contingency plans and business continuity strategies to ensure operations can continue in the event of a disruption.

Reactive Risk Mitigation Approaches

Reactive risk mitigation approaches, on the other hand, involve responding to risks after they have occurred. While these strategies may not prevent risks from happening, they focus on minimizing the damage and recovering quickly from the impact. This can include insurance coverage, crisis management plans, and post-incident reviews to identify areas for improvement.

- Obtaining comprehensive insurance coverage to mitigate financial losses resulting from unforeseen events.

- Establishing a crisis management team to coordinate responses and communication during emergencies.

- Conducting post-incident reviews to identify root causes and implement corrective actions to prevent future occurrences.

Impact of Risk Mitigation on Business Resilience

Effective risk mitigation can significantly enhance a company’s overall resilience by reducing vulnerabilities, improving response capabilities, and ensuring continuity of operations. By proactively addressing risks and preparing for potential threats, organizations can better withstand disruptions, protect their assets, and maintain a competitive advantage in the market.

In conclusion, implementing robust risk management strategies is vital for safeguarding business interests and fostering resilience in the face of uncertainties. By understanding the intricacies of risk assessment, management, tolerance, and mitigation, organizations can navigate challenges effectively and seize opportunities for growth.

Answers to Common Questions

What are some common risk assessment tools?

Common risk assessment tools include SWOT analysis, Monte Carlo simulation, and decision tree analysis.

How does risk tolerance impact investment decisions?

Risk tolerance influences investment decisions by determining the level of risk an individual or organization is willing to take on for potential returns.

What is the difference between risk avoidance and risk transfer?

Risk avoidance involves avoiding activities that could lead to risks, while risk transfer shifts the risk to another party through insurance or contracts.